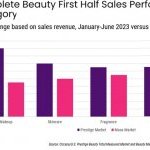

U.S. prestige beauty industry sales amounted to USD 14 billion in the first half of 2023, a 15% increase versus the same period in 2022. In comparison, the mass beauty market generated USD 28 billion and grew 9%, according to Circana, formerly IRI and The NPD Group.

“Beauty continues to be the darling of retail through the first half of 2023, maintaining its position as the only industry to grow based on units sold across the general merchandise and consumer packaged goods categories Circana tracks,” said Larissa Jensen, beauty industry advisor at Circana. “The beauty industry is hitting the right notes, meeting consumers’ emotional needs through new and existing products, which is especially welcomed at a time when spending power continues to be squeezed.”

Makeup is making moves

Makeup ended the first half of 2023 as the fastest growing category within the prestige market, with sales revenue up 18%, and outpaced sales at mass merchants by growing at twice the rate. Within the category, lip makeup was the fastest-growing segment, and inclusive of both prestige outlets and mass merchants.

These results come during a time when makeup usage is also on the rise. According to Circana’s 2023 Makeup Consumer Report, makeup usage increased by 3 percentage points in the past year and has surpassed pre-pandemic levels.

Skincare sentiment is shifting

Face serum, body spray, and facial cleansers were the top gainers in the prestige skincare market for the first half of the year. Fueled by new launch activity, clinical brands brought in the majority of the prestige skincare sales gains.

Overall facial skincare usage in the U.S. remains flat compared to last year, according to Circana’s 2023 Facial Skincare Consumer Report. While usage remains consistent, product preferences are shifting. Consumers are increasingly turning to hybrid products that together address skin concerns and provide makeup coverage. In addition, more channel blending is taking place as 67% of consumers feel that skincare brands at drug stores or mass merchandisers are as good as higher priced department store brands, a sentiment which is up from last year.

Fragrance consumers flock to value

Gift sets, higher concentration fragrances, and mini sizes are outperforming the overall prestige fragrance market. Sales of fragrance gift sets grew by 26%, or twice the rate of the market. Eau de parfums and parfums were the only formats to experience a year over year increase in units sold. Minis, or fragrance sizes under one ounce (28 ml), accounted for 38% of total fragrance juices sold.

Hair reaches new heights

Although sales revenue is significantly higher in the mass market, hair product sales continue to grow at a faster clip in the prestige business, with online capturing about half of the sales. Furthermore, hair is the category with the highest average price increase in the prestige beauty market, growing at three-times the rate of the overall industry. Styling was the fastest-growing segment in prestige hair for the first half of the year.