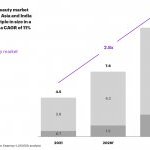

Global consultancy Kearney and Luxasia, one of the largest distributors of luxury beauty in Asia Pacific, recently released a whitepaper titled "Unlocking hyper-growth in Asia’s luxury beauty landscape". According to the report, Southeast Asia and India are poised to witness the next "gold rush" in luxury beauty, reaching a market potential of USD 7.6 billion by 2026, almost tripling in size within 10 years, with a projected 11% CAGR between 2021 and 2031 [1] (figure 1).

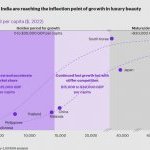

The research also reveals that Southeast Asia and India are nearing an inflection point and are poised to enjoy a decade of double-digit growth in luxury beauty (figure 2).

In contrast to China, Japan, Singapore, and South Korea, other markets in Southeast Asia and India are relatively unsaturated, with limited presence of both international luxury beauty brands and compelling local ones. As these economies mature, the upper- and middle-classes are projected to surpass 1 billion people in 2026 [2], with more consumers expected to trade up from mass to luxury.

These market conditions trigger the proliferation of local beauty brands, which tend to play in the masstige category, leaving the luxury beauty segment as an opportunity for international brands.

“This presents a limited but golden window of opportunity for luxury beauty brands to enter now and flourish,” said Luxasia in a statement.

However, harnessing growth remains tricky, due to diverse market ecosystems in Southeast Asia and India. Luxury brands today face six major challenges in this fragmented region, which include: multidimensional omni-retail networks; heterogeneous local product preferences; divergent marketing approaches; challenging regulatory frameworks; costly and idiosyncratic supply chain landscapes; and partner selection amid information asymmetry.

Thus, there is no longer a Southeast Asian consumer or an Indian consumer, highlight the authors of the report. "Each consumer is now ’glocal’ and is likely aware of a brand’s messaging in the US, Europe, and North Asia markets but also deeply rooted in local preferences. It’s crucial to represent brands globally in an integrated manner and react locally to global trends."

Correspondingly, the report outlines six execution imperatives to effectively tackle these challenges. These include optimizing the retail footprint to create multi-touchpoint experience hubs; harnessing continued e-commerce growth unique to each market; forging capabilities to ride social commerce acceleration; building deep local consumer understanding through data aggregation and analytics; leveraging logistics partners to build a robust and flexible network; and winning with the right omnichannel brand-building partners.

Since the beginning of the year, many international luxury players have announced their entry into India, or into Southeast Asian markets, with Shiseido and Nars being the latest examples. The impressive growth of the Cosmoprof CBE ASEAN trade show, launched just one year ago, also illustrates the dynamism of the region.